Snap Inc., the parent company of Snapchat, has published its latest performance update, showing improved revenue performance, and a steady increase in users, as it works to get its business elements back on the right track.

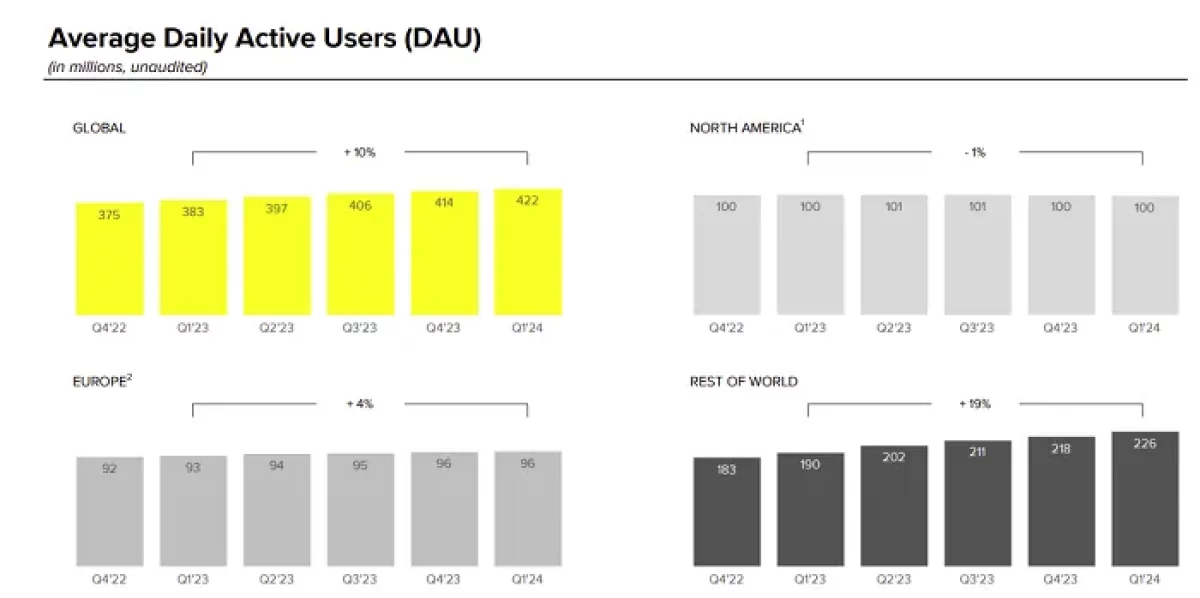

First off, in terms of users. Snapchat is now up to 422 daily actives, an increase of 8 million users on the previous period.

Which is good, but the worrying sign for Snap is that it’s still not gaining traction in its key revenue markets, with U.S. and EU usage remaining flat in the period.

Gaining more users in emerging markets is important for future growth prospects, as more users equals more opportunity. But at the same time, these regions don’t currently bring in anywhere near as much revenue for the app.

As you can see in these charts, Snap brings in way more income from its U.S. audience, and almost double the A.R.P.U. from European users as the “Rest of the World” category.

That’s why in its last update, Snap noted that it would be putting more focus on growing its U.S. and EU audiences, as opposed to other regions, but thus far, that hasn’t had an impact, at least on user growth.

In terms of specific behaviors, Snap says that total time spent watching its TikTok-like Spotlight video feed increased more than 125% year-over-year. That underlines the significance of TikTok’s influence on the broader social media landscape, and why some believe that Snap is poised to take a leap, if TikTok does eventually end up exiting the U.S.

Back in 2020, when TikTok was banned in India, Snapchat was indeed a big winner, with app downloads effectively doubling in the region. Though it’s a much different situation in the U.S., and that was also before the arrival of Instagram Reels and YouTube Shorts, so it’s unlikely to see the same type of bump this time around.

But it might get more attention, though I would still expect TikTok to remain in operation in the U.S., in some form, after the divestment deadline passes.

Snap also notes that its “Snap Stars” program, which offers additional features to approved, high profile creators, has helped to drive more engagement with the total time spent watching Stories from Snap Stars growing more than 55% year-over-year in North America.

As per Snap:

“We onboarded over 1,500 Snap Stars in Q1, which has helped generate quarter-over-quarter growth in Story posts, Spotlight posts, and Stories time spent for Snap Stars globally.”

The initiative aims to keep these high profile creators posting to the app, and that is seemingly having a positive impact on engagement.

In terms of revenue, Snap brought in $1,195 million for the period, an increase of 21% year-over-year.

Snap says that improvements in its machine learning models are driving better results for its ad partners, with small and medium sized advertisers, in particular, seeing significant benefits.

“In Q1, ongoing momentum with our 7-0 Pixel Purchase optimization model – which enables advertisers to bid for attributed 7-day clickthrough conversions – led to a more than 75% increase in purchase-related conversions year-over-year. We expanded 7-0 optimization to app install and app purchase in Q1, and will expand testing of additional app goals in Q2, which include our capabilities to support Value Optimization and Custom Event Optimization.”

Somewhat amazing, Snap also says that the number of small and medium sized advertisers in the app increased 85% year-over-year, which it attributes to its simplified ad creation process.

I mean, that’s a big jump, and it’d be interesting to get more insight into exactly how Snap has driven such a major boost in uptake.

Snapchat also notes that Snapchat+, its subscription offering, is now up to 9 million paying members, rising from 5 million in September last year. Snap added an option to gift Snapchat+ memberships back in December, and that seems to have had an impact on take-up over the Christmas period.

That means that, at $US3.99 per member, Snap’s now making around $35 million per month from Snapchat+. Which is still only a fraction of its total ad intake ($100 million per quarter), but it’s a handy additional revenue stream, which also shows how subscription social can work, within certain parameters and contexts.

Looking ahead, Snap says that it expects to reach 431 million daily active users in Q2, with revenue guidance between $1,225 million to $1,255 million, or growth of 15% to 18% year-over-year.

These are good numbers for Snap, especially after its less-than-amazing Q4 performance update. And while it still has a way to go in getting its business back on track, the results here suggest that it is focusing on the right areas, which will help to bring in more revenue from its key income regions.